Dimensional Fund Advisors, Inc. (DFA)

Our predominant provider of low-cost, well-diversified, and tax-efficient Mutual Funds and ETFs is Dimensional Fund Advisors, Inc. DFA has shared the same investment philosophy since we began managing client investments. DFA is an independent investment company that I do not receive any compensation from, nor do I pay them anything directly. Please see the following quick one page slides, videos, and information about DFA and their investment products.

I specialize in helping clients who are entering retirement or are already in it. My tax background enables me to offer a service with lower costs, greater expertise, and access to more effective investment options. I focus on what I consider to be the main areas of asset management—the growth, distribution, preservation, and protection of assets. I can help those who need advice in just one area or develop a more comprehensive plan.

I’ve provided financial planning and investment management services for over 25 years. I’ve always been independent and a fiduciary. I’ve always felt that working in my client’s best interests was compromised if I worked at a company that sells proprietary products and competed with other producers to win trips and awards. I know where that money is coming from. As an independent advisor, I can choose my cost structure and the investment companies that align with my investment philosophy. Over 25 years ago, I selected two companies—Vanguard and Dimensional Fund Advisors —to primarily supply the funds I manage for my clients. These companies share my belief in long-term, disciplined investing, and their funds have consistently delivered strong returns, providing my clients with the best possible outcomes.

They face a balancing act between all the main areas of asset management – the growth, distribution, preservation, and protection of their assets. They are nearing or at the end of the accumulation phase, where higher risk tolerances and greater potential returns could be afforded due to longer time horizons and lower liquidity concerns. Now that they’ve reached or will soon be reaching retirement, their risk factors begin changing – the sources of income may have varying tax consequences, time horizons grow shorter, and inflation and liquidity concerns become greater. Meanwhile, they keep an eye on asset preservation as family transfer goals become increasingly important.

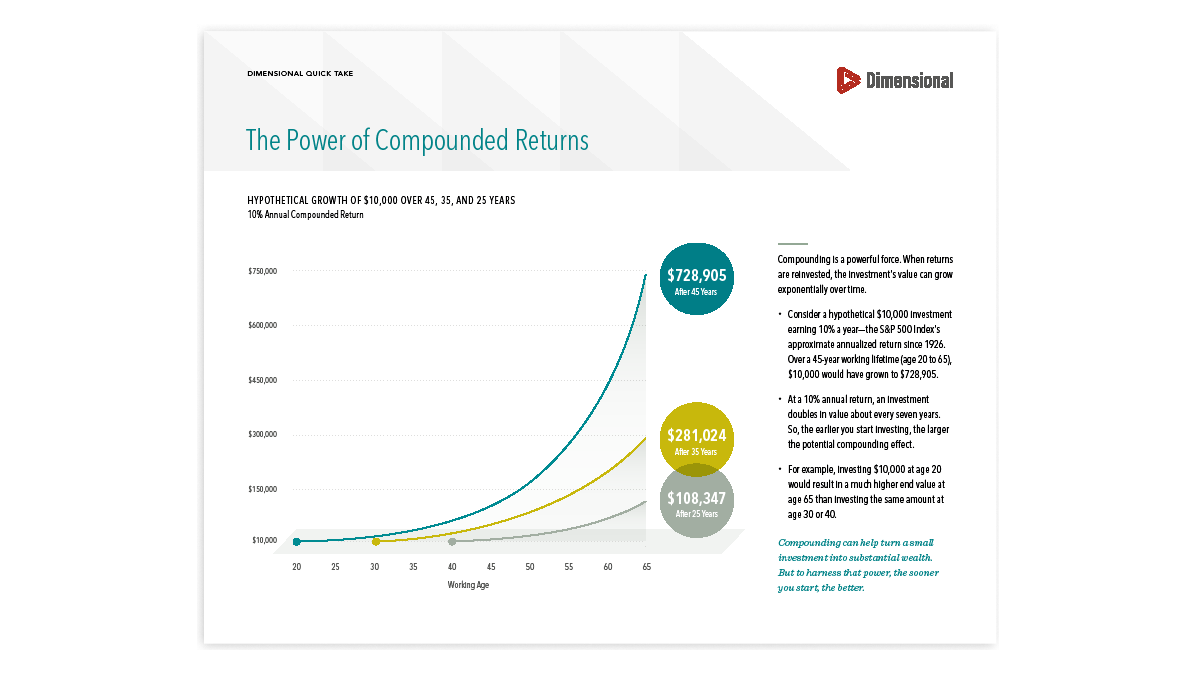

Speculation is a zero-sum game, meaning the amount of somebody’s gains will equal someone else’s losses. Success with this strategy depends on a 50/50 chance of being on the correct side of the transaction and overcoming the additional costs and possible taxes associated with each transaction. Disciplined investing leverages the market’s natural process of rewarding investors with returns that align with their risk tolerance. Typically, the longer the time horizon is, the greater the potential for favorable investment returns, as investors with long time horizons are more likely to withstand short-term market volatility.

Determining the appropriate level of risk requires an analysis of several factors, including goals and objectives, liquidity needs, investment time horizon, cash flow, the nature of assets and liabilities, and, perhaps most importantly, personal attitudes toward risk.

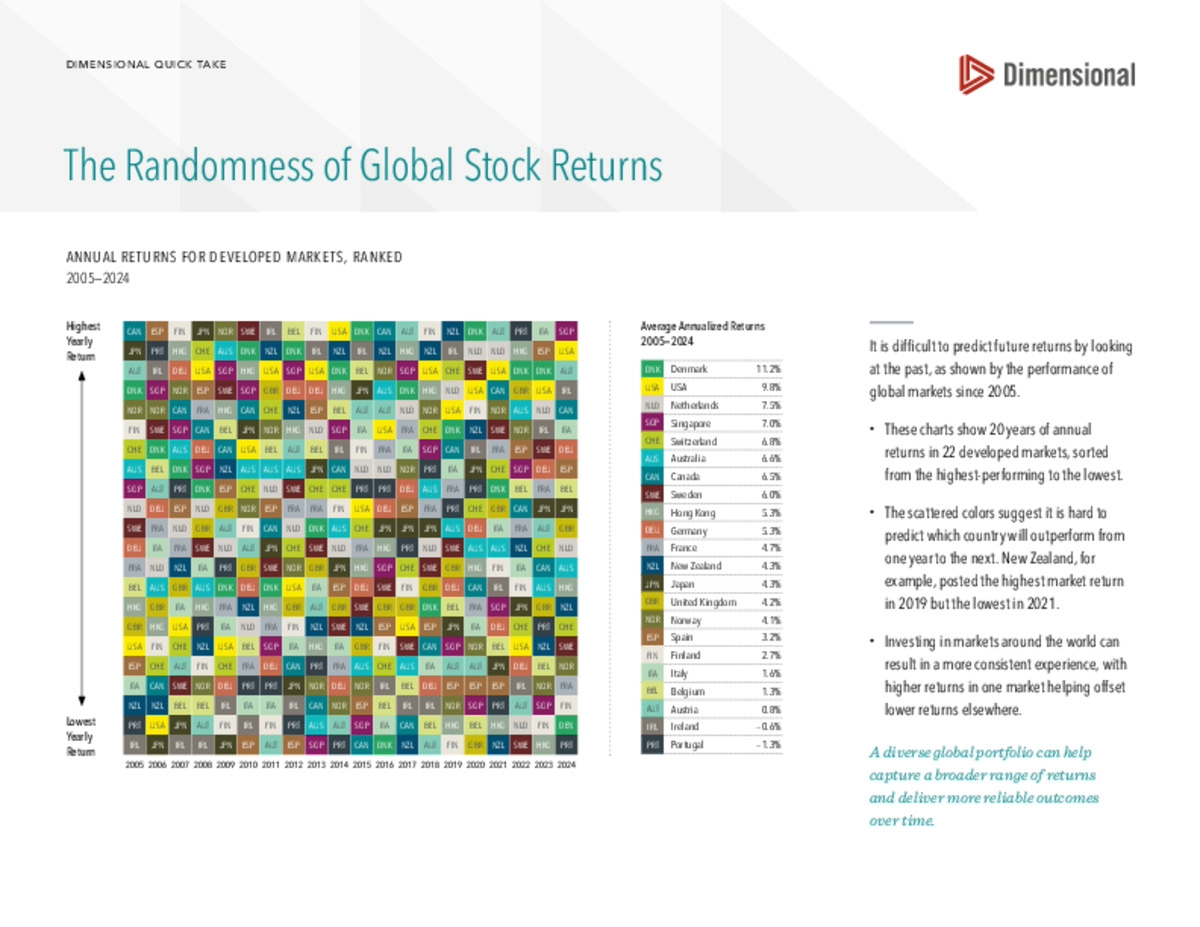

We’ve been conditioned to believe that almost anything can be accomplished through effort and hard work. That may be true, but trying to outsmart the market isn’t one of those things. Because of the size of the market and the number of highly skilled investment professionals competing in the market, it’s impractical to think it’s possible to outsmart the market, and there’s overwhelming evidence to support that it’s not only impractical but also counterproductive. By harnessing the market’s power, we put its collective knowledge to work for us instead of against us.

Any exposure to the risk of possibly outliving one’s assets should be addressed during the initial stages of the planning process. Once the gap between where clients want to be and where they are now is identified, a more realistic view of the necessary levels of growth and risk can be formed. If the corresponding risk levels are too significant to achieve the required return, then adjustments may be needed to client goals or their anticipated living expenses. The Investment growth piece of the planning process is critical to reaching goals, so we ensure that we are utilizing optimal investment strategies. I believe the best way to achieve long-term positive investment results is through low-cost, well-diversified, and tax-efficient investments that are designed to earn long-term capital appreciation. Then, of course, continuous monitoring of the plan is necessary to ensure that client objectives remain aligned with their planning strategies.

Deciding which alternatives to stocks and bonds would make sense to own in a portfolio requires evaluating the investment not just by itself, but also how the inclusion of the investment impacts an overall portfolio. Ideally, we aim to leverage the power of diversification by adding investments that can increase overall returns without significantly increasing overall risk, or reduce overall risk without sacrificing total returns. There are several alternative investments available, and ultimately, it’s the client’s unique financial situation that will dictate what’s best for them. Still, there are a few investments that I believe make sense for most situations, including publicly owned real estate, inflation-protected securities, international equities, and traditional fixed annuities, which essentially function like long-term CDs with the added benefit of tax deferral.

In most situations, a trust will prove to be more efficient. However, a properly drafted will that clearly defines which assets are going to whom can be just as effective as a trust in passing assets to desired beneficiaries. It certainly would be more convenient. A will can be created with just a pen and paper, and it can be done immediately and generally at no cost. But even the most straightforward will can have disadvantages, such as fees, delays, and privacy issues that could make the cost of preparing a trust worth the trouble. It will depend on the type of assets being passed.

When someone dies, the legal title is passed to the beneficiaries through either a trust, a will, or by intestate, which is having no will. Certain assets valued at over $150K have to be transferred through a process called probate. Real property, such as homes and rental property, or through the use of a trust. Another important element is the length of time it takes to complete the legal transfer of specific property from the deceased to their beneficiaries.

For instance, given that the divorce rate in the U.S. is 50%, there are a number of married men and women who have children from prior marriages and relationships and they want these children to receive assets from his or her estate, but not until the surviving spouse passes away. In other words, a spouse may want children from a prior relationship to receive a share of his or her assets, but they also want the surviving spouse to receive income from the trust until he or she dies, then the remainder goes to the children.

Investment Management

Investment management is a critical part of the planning process, but is nevertheless just a part of the process. The growth of investments will be the determining factor of whether your goals are achieved as planned.

Taking advantage of the markets instead of letting the markets take advantage of you. We’ve been conditioned to believe that almost anything can be accomplished through effort and hard work. That may be true, but trying to outsmart the collective market seems impractical, and there’s overwhelming evidence to support that it’s not only impractical but also counterproductive. By harnessing the market’s power, you put its collective knowledge to work for you, instead of against you.

I consider real investing to be a form of disciplined investing – but disciplined to your goals instead of committing to an investment come rain or shine. A simple “buy and hold” strategy may effectively lower trading costs, but expanding and improving on that cost advantage is possible. Once we’ve quantified our financial goals, it becomes easier to manage strategies, as we know our destination and the growth rate required to reach it. From there, it’s a matter of taking advantage of the market's natural process of rewarding investors for risk-taking, and that’s by constructing a well-diversified portfolio and having the discipline to reap the expected benefits.

Bio

Combining my tax, planning, and investment knowledge offers my clients a more efficient and streamlined source of useful information that helps them make better-informed financial decisions.

Independence

The first step in adding value is simply choosing an independent planner over someone who works for a company that sells proprietary products. There are other variables to consider, but I believe a client’s best interests are better served by someone who doesn’t have any monetary incentives to sell products – I’m not in competition to win trips, cruises, or stays in luxurious resorts. I understand precisely where the money comes from to pay for all that.

Being a fiduciary requires always acting in the client's best interest. This should seem plain and obvious, but surprisingly, many individuals in the planning industry are not legally bound to a “best interest standard.” Instead, they are held to a less stringent “suitability” standard, which means as long as a product sold to you is considered suitable to your needs, there are no reasonable limitations on the cost of that product, including commissions.

Other requirements of the rule are disclosing any conflict-of-interest issues, including any revenue-sharing agreements that companies often make with other companies, and full disclosure of all fees, either paid directly or indirectly, which is what we call “hidden fees.”

I take pride in helping educate clients on areas pertinent to their lives – things that currently impact them and will affect their plans.

Financial Planning

The challenge for me is to communicate the results of a plan to a client in a way that is compatible with their goals and objectives. It’s more a vision of a desired future than projecting numerical asset values. Most of what I do is take information–numbers, and I crunch them, analyze them, and do what I do to them, and I’ll produce a plan that essentially consists of more numbers. I may see the connections between the finished numbers as a way to realize their goals, but I’m not the one who is being asked to commit to the plan. Therefore, unless I can translate the solutions I’ve created to match the client's vision, it’s highly unlikely that they’ll remain committed to the plan and wish to monitor or update it. What happens, unfortunately, is that plans get filed away in a drawer, never to see the light of day.

The accumulation phase typically spans many years, during which families are formed, assets are acquired, and one or both spouses advance in their careers.

The sources of income may be from wages, business interests, investments, rentals, royalties, and possibly inheritances. The investment strategy during this phase has the advantage of longer time horizons, which may allow for greater risk tolerance and higher expected returns.

The distribution stage generally begins at retirement, and I consider this stage to be the most challenging, as it requires a delicate balancing act between all phases of the financial cycle. There’s still a need to accumulate wealth, identify the most efficient tax distribution strategies, and preserve wealth. But as we move farther along the financial life cycle, risk factors change – once retirement begins, income may be reduced, sometimes significantly. Time horizons are growing shorter, and concerns about liquidity and inflation are increasing. The result of the changing risk factors is that the risk level the investor is willing to accept is usually lower than during the accumulation phase. However, reducing risk exposure typically means accepting lower expected returns, which may create long-term issues if inflation rates persistently outpace the returns on investments.

The preservation phase is generally associated with much lower risk tolerances due to shorter time horizons. The emphasis for those in this stage is usually keeping what they have to fulfill family transfer goals and ensuring sufficient income for possible longer life expectancies.